Technologies

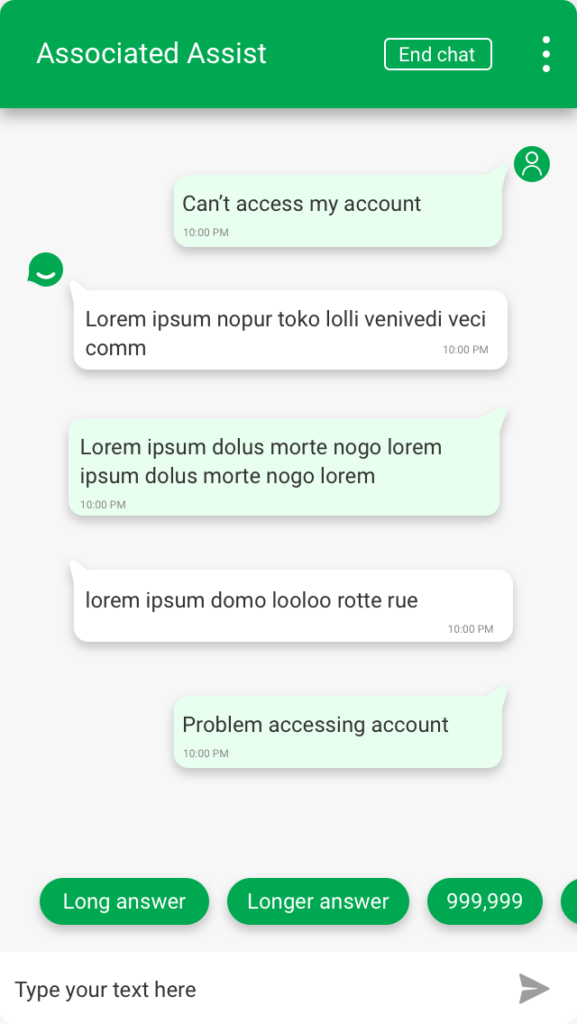

Chatbot

Personetics Assist: A Personalized Digital Self-Service Solution for Enhancing Financial Customer Experience

In the dynamic and competitive financial services industry, providing exceptional customer experiences is crucial for fostering long-lasting relationships and driving business growth. Personetics Assist emerges as a transformative solution, revolutionizing digital self-service interactions by offering personalized, context-aware, and timely support resources. This comprehensive solution empowers financial institutions to elevate the customer experience across all touchpoints, from websites and mobile apps to popular messaging platforms and personal assistants.

Enhanced Customer Satisfaction:

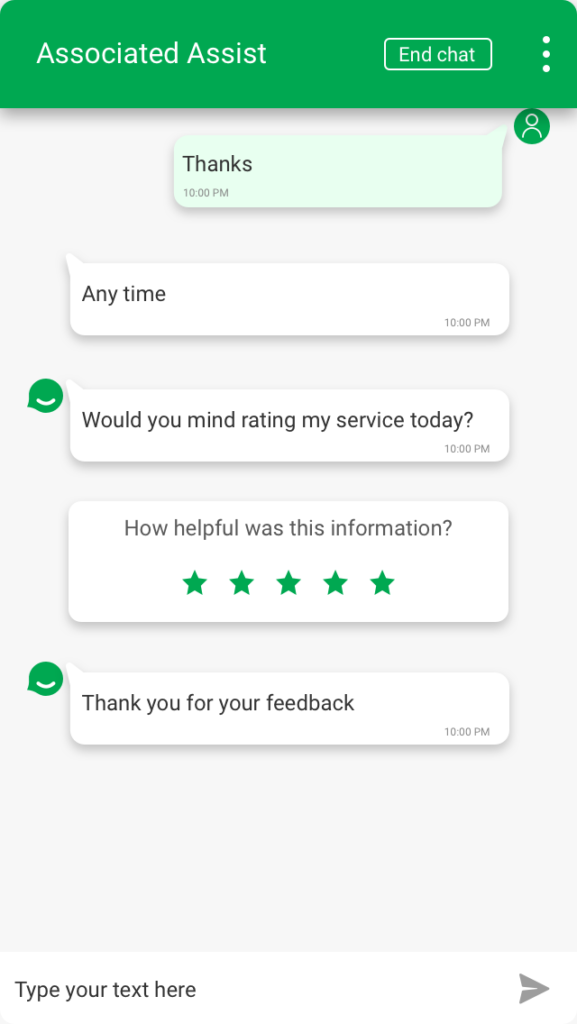

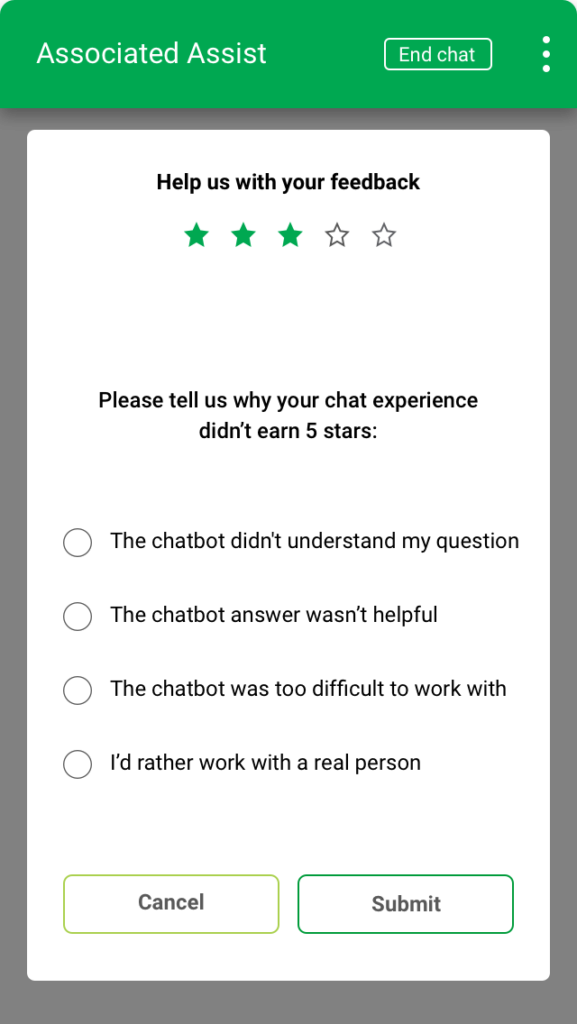

-Personetics Assist fosters personalized interactions that cater to individual customer needs and preferences, leading to improved satisfaction and loyalty.

Reduced Operational Costs:

– By proactively addressing customer inquiries and providing self-service solutions, Assist minimizes the need for excessive call center support, reducing operational costs.

Increased User Engagement:

– By delivering relevant and actionable guidance, Assist keeps customers engaged and informed, fostering deeper interactions with the financial institution.

Improved Sales Conversion:

– Personetics Assist can effectively cross-sell and upsell products and services by recommending options tailored to individual customer profiles.

Enhanced Financial Wellness:

-Assisted by Personetics, customers can gain insights into their financial habits, enabling informed decision-making and financial well-being.

Industry Standards and Alignment

Personetics Assist adheres to industry-recognized standards for data privacy, security, and compliance, ensuring the protection of customer information and adherence to regulatory requirements. The solution integrates seamlessly with existing financial institution systems, simplifying implementation and maximizing its impact.

Technologies Empowering Personetics Assist

At the core of Personetics Assist lies a robust technology stack that powers its capabilities:

Natural Language Processing (NLP):

– NLP enables natural and conversational interactions between customers and the Assist chatbot, understanding their intent and providing relevant responses.

Machine Learning (ML):

-ML continuously analyzes customer data to identify patterns and preferences, enabling personalized recommendations and tailored guidance.

Predictive Analytics:

– Predictive analytics forecasts customer behavior, allowing Assist to proactively address potential issues and minimize churn risks.

API Integration:

-Personetics Assist seamlessly integrates with existing financial institution systems, leveraging transaction data and customer information for personalized assistance.

Cross-Channel Deployment:

– Assist can be deployed across multiple channels, including websites, mobile apps, messaging platforms, and personal assistants, ensuring consistent customer support across all

Personetics Assist emerges as a game-changer in the financial services industry, revolutionizing digital self-service interactions by delivering personalized, context-aware, and timely support. By leveraging cutting-edge technologies and aligning with industry standards, Assist empowers financial institutions to enhance customer satisfaction, reduce operational costs, and drive business growth. With Personetics Assist, financial institutions can establish themselves as trusted partners, fostering long-lasting relationships with their customers.